What is the current status?

At the moment, kerosene – or more generally, aviation fuel – is still tax-exempt. This is different from, for example, car fuel, on which you pay hefty excise duty at petrol stations in the Netherlands. The tax exemption for aircraft applies across almost the entire world. Only a few countries do have a kerosene tax; however, this usually applies only to kerosene for domestic flights. In Europe, the tax exemption is regulated by the Energy Taxation Directive, or ETD.

So what about the Chicago Convention?

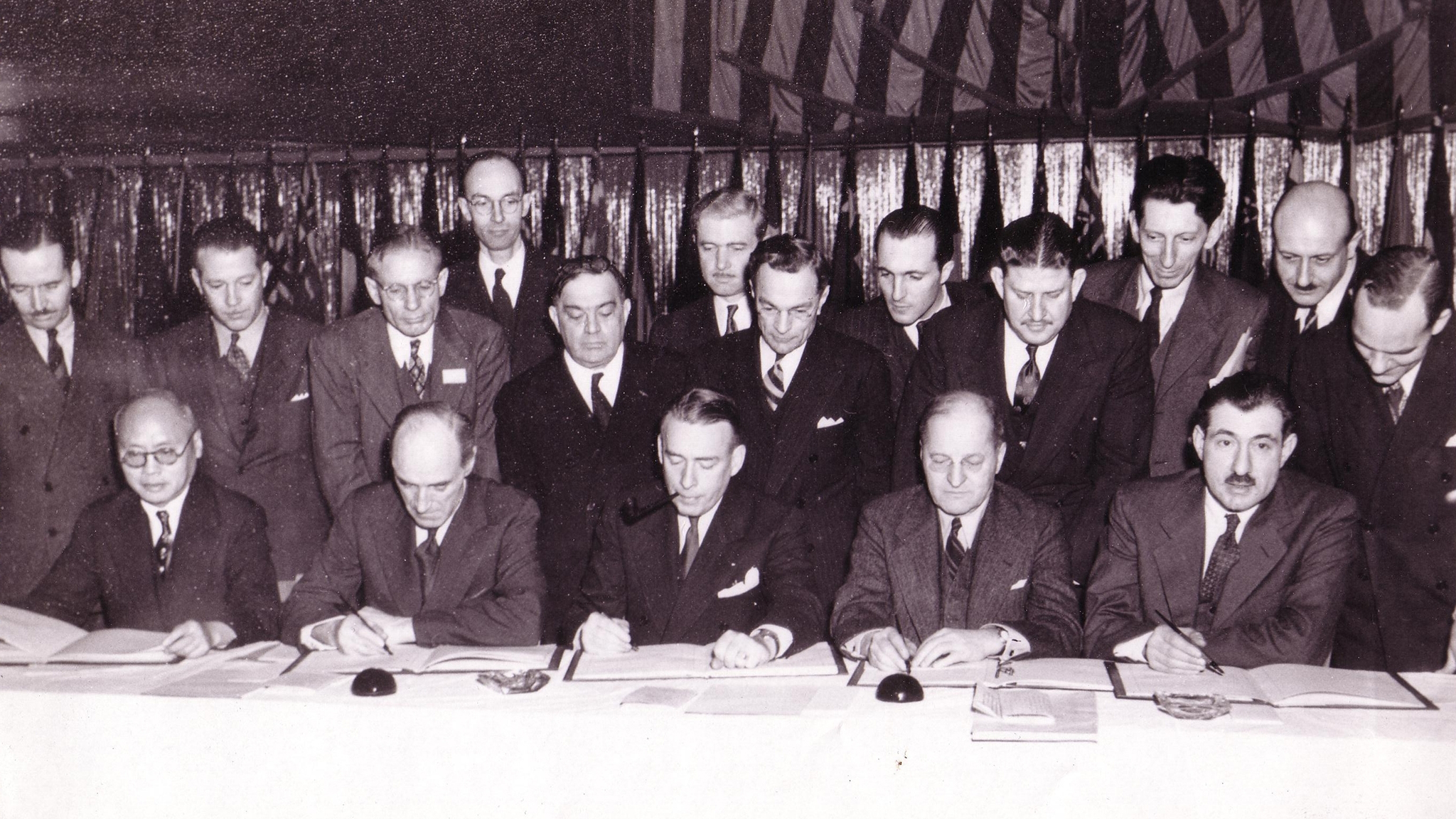

This is indeed different from what you often hear, namely that the tax exemption on kerosene is an agreement from the Chicago Convention (Dutch translation also available). This established the International Civil Aviation Organisation (ICAO) in 1944.

- Fuel, lubricating oils, spare parts, ordinary equipment and supplies which are on board an aircraft of a Contracting State upon arrival in the territory of another Contracting State and which are still on board upon departure from the territory of that State shall be exempt from customs duties, inspection costs or similar national or local duties and charges.

In summary, it says that fuel that was in the tank upon arrival and is still in the tank upon departure from the country is exempt from taxation. This is a logical exception, since goods transported from one country to another are normally subject to an import tax. It would be strange if this applied to fuel in your tank. It is also good from a safety point of view that this ‘residual fuel’ remains untaxed. If it were taxed, it would be a financial incentive to arrive at the destination with as little fuel as possible, and therefore perhaps take less fuel on board for the flight. Potentially extremely dangerous! However, the Chicago Convention does not mention anything about fuel used in flight.

So ICAO has nothing to do with this tax exception?

Well, that is not exactly true either, since ICAO did in fact speak out about taxing kerosene, through an ICAO Council resolution:

- The Council resolves that: 1. With respect to taxes on fuel, lubricants and other consumable technical supplies: a) when an aircraft registered in one Contracting State, or leased or chartered by an operator of that State, is engaged in international air transport to, from or through a customs territory of another Contracting State, its fuel, lubricants and other consumable technical supplies shall be exempt from customs or other duties on a reciprocal basis.

This resolution therefore does prescribe a tax exemption for (among other things) fuel. Crucial to this is the question of whether this rule (‘shall’) is binding or not. Some scientists (implicitly) argue that it is, others that it is not. The latter view is in line with a later passage from that resolution, which ‘encourages’ countries to apply the exemption to the extent possible:

- c) notwithstanding the underlying principle or reciprocity, Contracting States are encouraged to apply the exemption, to the maximum extent possible, to all aircraft on their arrival from and departure for other States.

If that ICAO resolution is not binding, where does the exemption come from?

Read more

In Europe, the tax exemption on kerosene is regulated by the Energy Taxation Directive mentioned earlier, specifically Article 14. Indeed, it states that Member States should exempt from taxation ‘energy products supplied for use as fuel for the purpose of navigation other than private pleasure flying’¹. The Open Skies Treaty between Europe and the United States also contains an agreement on the reciprocal non-taxation of kerosene. Ultimately, those agreements are reflected in a bi- or multilateral aviation treaty that is enacted as law. And with that, the exemption becomes a fact.

Where this is established seems like just a technicality. Does it really matter?

In this case – where the Commission is concerned with a kerosene tax on flights within Europe – it is. ICAO is a global body. So if the exemption were enshrined in the Chicago Convention, there should also be global agreement to amend it. Because of the narrower scope of the Commission’s proposal, this is not necessary in this case; it is a purely European matter.

What exactly does the European Commission want to change?

The European Commission has previously indicated that it finds the exemption in stark contrast to environmental goals and that taxes should instead be in line with climate ambitions. The proposal presented on 14 July (notably pages 16, 26, 40-41 and 77-79) largely removes this exemption. The directive now sets a minimum tax rate per (energy) amount of kerosene, which becomes applicable to intra-European flights, except for aircraft used entirely for cargo transport. For pleasure and business transport (in separate business jets), the minimum rate will be fully levied by 2023, while there will be a transition period for other passenger transport. In this transition period, the tax rate builds up in 10% increments – also starting in 2023 – to 100% of the minimum rate in 2033. By retaining the exemption (for now) for different types of renewable fuels, the Commission probably hopes to encourage their production and use.

What does this involve?

A lot, as you can imagine. If only because the final binding agreement is made in aviation treaties. Within the European Community, this is enshrined in a single multilateral treaty. This is not to say that such an amendment will be easy, but it is expected to be less complicated than amending dozens of separate treaties. Another complication is that European tax legislation is something that – at present – must be decided unanimously by Member States. In any case, these proposals also need to be approved by the European Parliament and the Council. So there are still some negotiations to come….

I hope that with this blog I have been able to clarify some things – and, more importantly, explain – why in this case, Europe can take unilateral decisions on this.

¹The keen reader will notice that the (English) Directive also prescribes this exemption with the word ‘shall’. However, that regulation has been followed in a binding way, as it has been included in aviation treaties of the European Union and Member States, for example in those of the European Community (via Annex I, Chapter H). The Directive is referred to therein as ‘Directive 2003/96/EC’.